Tianneng Group Released Its Interim Report: Revenue Hit a Record High and New Business Momentum Was Strong

Tianneng shares today released the 2022 semi-annual report. Facing the complex and turbulent external mar ket environment, Tianneng shares intensified transformation and upgrading around the established strategic policy, achieved stable growth in performance, and handed over a "transcript" with frequent highlights.

The report shows that in the first half of this year, Tianneng's operating income was 17.227 billion yuan, a year-on-year increase of 5.98%, setting a new record high again; net profit was 752 million yuan, an increase of 11.95% year-on-year; earnings per share were 0.77 yuan, an increase of 8.45% year-on-year.

Steady development of cornerstone industries and strong growth of emerging businesses

Tianneng further consolidated its traditional dominant position in the field of lead-acid batteries. In the first half of the year, the business revenue was 14.856 billion yuan, a year-on-year increase of 8.35%. It is worth mentioning that, benefiting from the adjustment of the pricing mechanism in the second half of 2021 and effectively controlling the adverse impact of rising raw material prices on the cost side, the gross profit level of the lead-acid battery business recovered to 19.28%, an increase of 0.96 percentage points over the same period last year;

Tianneng is investing more than 9 billion yuan to expand the lithium-ion battery project. With the gradual release of lithium battery capacity, it has brought about rapid growth in revenue. During the reporting period, the company achieved a lithium battery business income of 795 million yuan, a year-on-year increase of 86.86%;

Hydrogen fuel cell is a strategic new industry that Tianneng focuses on cultivating. The company continues to increase investment in research and development, focusing on systems and stacks, strengthening research on key materials and core components, improving the level of technology development, enhancing the core competitiveness of products, and expanding scientific and technological influence. In the first half of the year, the company has completed a pilot-scale assembly line with a production capacity of 500 (sets/year), the self-developed T70 system has passed the compulsory inspection, and the Jiangsu Shuyang base with an annual output of 3,000 sets of fuel cell engine systems is progressing steadily.

Hydrogen fuel cell is a strategic new industry that Tianneng focuses on cultivating. The company continues to increase investment in research and development, focusing on systems and stacks, strengthening research on key materials and core components, improving the level of technology development, enhancing the core competitiveness of products, and expanding scientific and technological influence. In the first half of the year, the company has completed a pilot-scale assembly line with a production capacity of 500 (sets/year), the self-developed T70 system has passed the compulsory inspection, and the Jiangsu Shuyang base with an annual output of 3,000 sets of fuel cell engine systems is progressing steadily.

Anchoring the strategic goal carbon peaking and carbon neutrality and developing the energy storage system track

In the context of "carbon neutrality and carbon peaking", the energy storage industry is faced with broad market opportunities, and Tianneng is accelerating the development of the energy storage market. Benefiting from the positive impact of the national energy storage policy and the market's recognition of lead-carbon energy storage technology, the company's lead-carbon energy storage business showed a growth trend in the first half of the year, completing business income of 76.5999 million yuan, a year-on-year increase of 762.80%; lithium battery energy storage also performed well, which not only has strategic cooperation with Datang Group, Huaneng, State Grid, etc., but also has been widely recognized by industrial and commercial energy storage customers. In the first half of the year, the revenue of lithium battery energy storage business was 223 million yuan.

In the future, the company will seize opportunities in the new energy storage business sector, make in-depth layouts, focus on new tracks, and actively carry out "new energy + energy storage" pilot demonstrations. While doing well in China's energy storage market, it will actively speed up expanding energy storage overseas market to help achieve the global carbon neutrality goal.

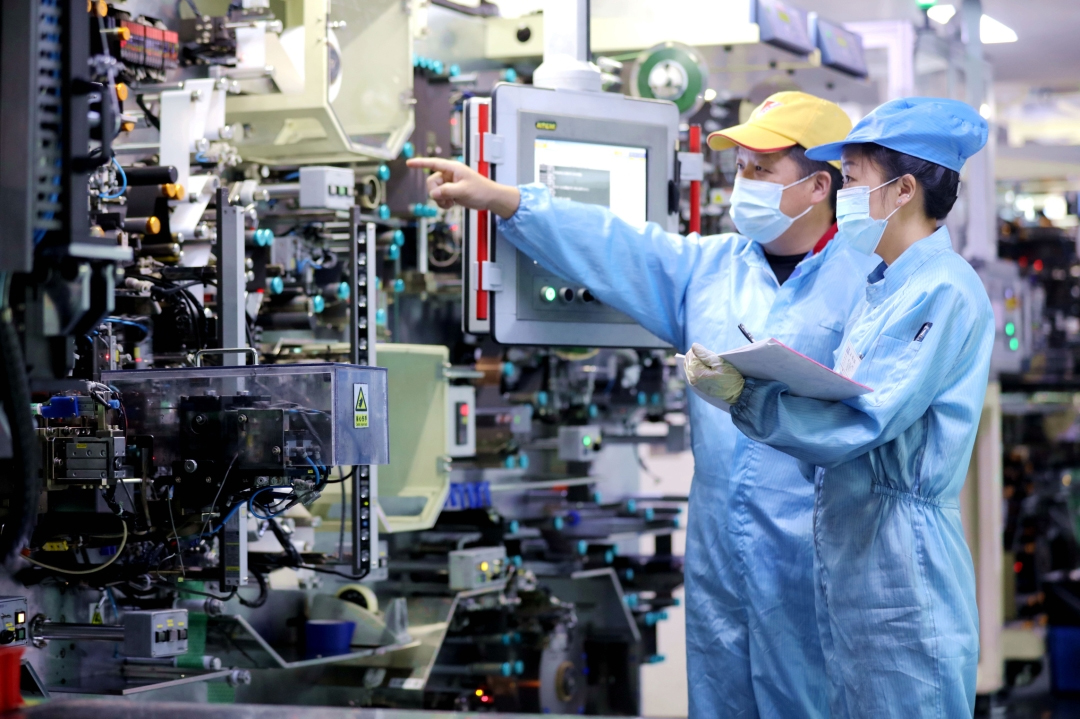

Increase investment in scientific and technological research and development to stimulate the growth momentum of scientific and technological innovation

In the first half of the year, the company took root in the lead battery business, vigorously developed the lithium battery business, and continued to explore new battery technologies such as fuel cells, sodium-ion batteries, and solid-state batteries. By continuously strengthening the overall R&D investment, the company continues to maintain the leading edge in technology in the industry.

During the reporting period, the company's research and development expenses increased by 12.5% to 665 million yuan; the number of research and development personnel reached 1,993, accounting for 7.93% of the company's total staff, which continued to increase steadily compared with the previous year; as of June 30, the company has owned patents 2993 items, including 613 invention patents.